Belfast City Council Case Study

Onepoint delivers a PoC aimed at improving and maximising the collection of business rates collection for a local authority within the United Kingdom.

About the Client

Our client is a UK local authority which serves an estimated population of 333,871 in a region that comprises six district councils based in dormitory commuter towns. The six combined councils provide the services and infrastructure for a total population of 579,276, having invested a sum of £50 million into infrastructure development in 2016 alone. This is essential to the continued prosperity of the regions, as tourism and business footfall generated some £324 million towards the city’s economy, an annual increase of 14%.

Business Drivers

Maximising business rate revenue was the key objective of this project, as:

- Rate Income provides important revenue for the Central Government Executive as well as the associated District Councils.

- Non-domestic rate income provides approximately half of the total revenues for the Council.

- It is vital to maximise the yield from the existing tax base to promote regional development.

- The stagnant rate base was deemed to be out of control.

The Requirement

The key requirements of this project were to:

- Identify the occupancy status of non-domestic properties;

- Ensure that all existing rateable properties are on the Valuation List;

- Confirm the use of non-domestic properties;

- Expedite the time period from a property becoming rateable to the issuance of the rate bill;

- Utilise data to increase rates of payment compliance.

The Solution

In conjunction with our partners, ‘The Behaviouralist’, we presented a 2-step solution which incorporated data science, behavioural science, experimentation techniques and software development expertise.

Step 1 – Development of a digital data hub to maintain up-to-date property occupancy status data and business rate registrations using ETL, analytics, web scraping and data streaming tools.

Step 2 – Refining and enriching this dataset with additional proprietary datasets to understand the payment rates and registration accuracy for current businesses.

Advanced Data Matching and Analysis: This involves deterministic and probabilistic linking of several critical datasets using advanced techniques such as data normalization, fuzzy matching and text stemming. We employed the Talend data processing platform to generate a database of over 1,600 unregistered businesses occupying non-domestic properties; more than 2,700 unregistered businesses occupying residential properties; and over 200 unregistered charities and wrongly categorised properties that are incorrectly registered on the Council’s current records, thereby being subject to incorrectly calculated rates. Our initial solution comprised compiling, cleansing, linking and matching critical datasets procured from the Council (and from other sources such as Companies House, Yell, The Charity Commission, LPS Pointer data, and Water Data etc.). Additionally, we proposed Randomised Control Trials to discern the best communication methods to improve and update registrations by businesses; improve new registrations; and increase payment compliance. This will enable us to ‘casually’ understand whether, and to what extent, newly identified business are compliant with prevailing business rates.

Challenges:

- The availability and affordability of obligatory datasets required for the creation of the data hub.

- The amount and quality of data obtained.

To improve the accuracy of the results obtained, advanced record matching algorithms for normalising and cleansing the data were proposed. Maintaining a history of these changes will increase the quality of all new data entering the hub.

The Outcome

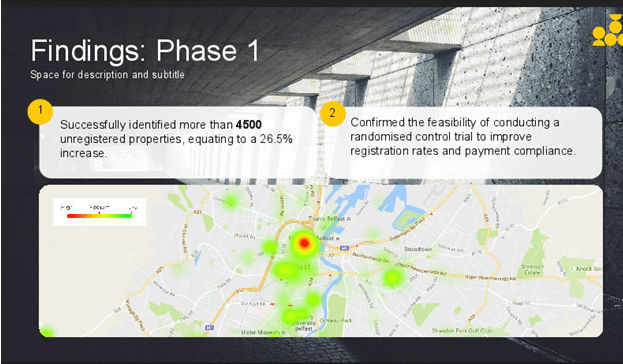

We successfully identified more than 4,500 presently unregistered properties, potentially equating to a 26.5% increase in business rate revenue. We confirmed the feasibility of conducting a randomised control trial to improve registration rates and payment compliance.

We successfully identified more than 4,500 presently unregistered properties, potentially equating to a 26.5% increase in business rate revenue. We confirmed the feasibility of conducting a randomised control trial to improve registration rates and payment compliance.

Case Studies Category

Industry

Local Government

Solution

Data Quality

Technology

Talend

Service

Talend Enablement Services